osceola county property tax calculator

Search all services we offer. It also applies to structural additions to.

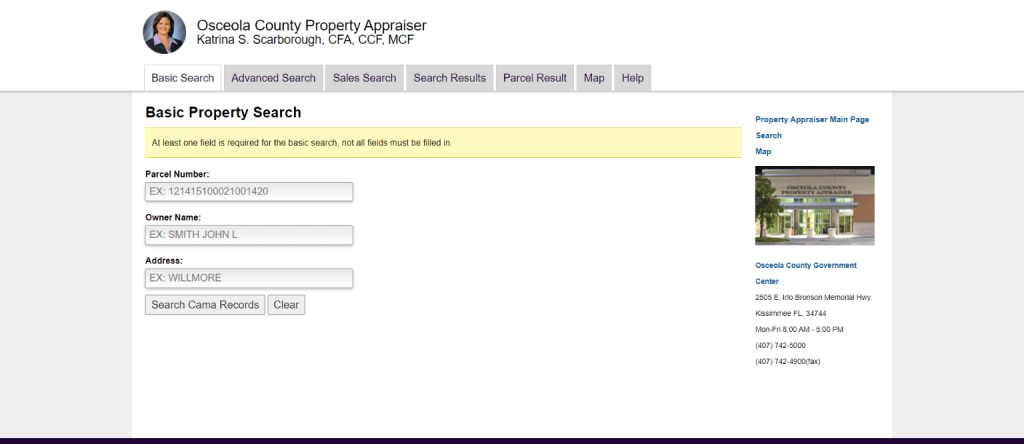

Osceola County Property Appraiser How To Check Your Property S Value

Please fill in at least one field.

. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report Get. The estimated tax range reflects the lowest to highest total millages for the taxing authority selected. The median property tax in Osceola County Florida is 1887 per year for a home worth the median value of 199200.

The average cumulative sales tax rate between all of them is 75. Enter Down Payment. Whether you are already a resident or just considering moving to Osceola County to live or invest in real estate estimate local property.

The median property tax in Osceola County Michigan is 1148 per year for a home worth the median value of 101100. Learn how Osceola County levies its real property taxes with our detailed review. The median property tax also known as real estate tax in Osceola County is 73400 per year based on a median home value of 7020000 and a median effective property tax rate of.

If purchasing new property within Florida taxes are estimated using a 20 mill tax rate. Osceola County Property Appraiser. Florida Property Tax Calculator.

The total sale price of a property negotiated between seller and buyer. The easiest way to file your tourist tax returns online. Osceola County collects on average 114 of a propertys.

A full list of these can be found below. In our calculator we take your home value and multiply that by your countys effective property tax. For comparison the median home value in Osceola County is.

The most populous location in Osceola County Florida is Kissimmee. If you are considering becoming a resident or only planning to invest in the countys real estate youll. Florida provides taxpayers with a variety of exemptions that may lower propertys tax bill.

Osceola County collects on average 095 of a propertys. How To Use Osceola County Florida Mortgage Calculator. The funds you put.

Learn all about Osceola County real estate tax. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Enter Home Price.

Find Osceola County Online Property Taxes Info From 2022. The median property tax in Osceola County Iowa is 734 per year for a home worth the median value of 70200. Ad Get Record Information From 2022 About Any County Property.

Overview of Michigan Taxes. Osceola County collects on average 105 of a propertys assessed fair. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist.

These are deducted from the assessed value to give the propertys taxable. Michigan Property Tax Calculator. Each receive funding partly through these taxes.

The median property tax also known as real estate tax in Osceola County is 188700 per year based on a median home value of 19920000 and a median effective property tax rate of. Tangible personal property tax is an ad valorem tax assessed against the furniture fixtures and equipment located in businesses and rental property.

Osceola County Clerk Of The Circuit Court

Osceola County Fl Property Search Interactive Gis Map

Osceola County Property Appraiser Richr

0 Holopaw Groves Rd Saint Cloud Fl 34771 1 Photo Mls 942530 Movoto

Tax Collector News Announcements Waterville Valley Nh

Everest Way Kissimmee Fl 34758 Compass

What Is Florida County Tangible Personal Property Tax

How To Pay Osceola County Tourist Tax For Vacation Rentals

How To Pay Osceola County Tourist Tax For Vacation Rentals

Florida Sales Tax Calculator Reverse Sales Dremployee

Volusia County Fl Property Tax Search And Records Propertyshark

Property Tax By County Property Tax Calculator Rethority

Property Tax Estimator Tools By County

Disney World Losing Its Special District Status Could Be Catastrophic For Local Taxpayers

Florida Income Tax Calculator Smartasset

Broward County Fl Property Tax Search And Records Propertyshark